The “Big Beautiful Bill” Explained and Why 2025 Is the Smartest Year to Invest in Your Drone Fleet

Discover how the One Big Beautiful Bill Act (OBBBA) lets small businesses deduct 100% of drone equipment costs in 2025. Learn how investing in Lucid Bots’ Sherpa Drones this year can maximize your tax savings and boost your cleaning business growth.

If you’re running a small building-services or cleaning business, you’ve probably heard some buzz about the “One Big Beautiful Bill Act” (OBBBA).

You don’t need to be a tax expert to understand it. This bill is a big win for small business owners investing in equipment that helps them grow.

Here’s what it means in simple terms, and how it could save you thousands when you buy a Sherpa Drone before the end of 2025.

What the Big Beautiful Bill Does

According to EisnerAmper’s Contractor’s Cheat Sheet, the OBBBA makes several long-term updates to U.S. tax law designed to boost construction, maintenance, and building upgrades.

Here are the two most important changes for small business owners buying tools or equipment:

- Permanent 100% Bonus Depreciation

Contractors and building-services companies can now deduct the full cost of qualifying equipment immediately, starting January 2025.

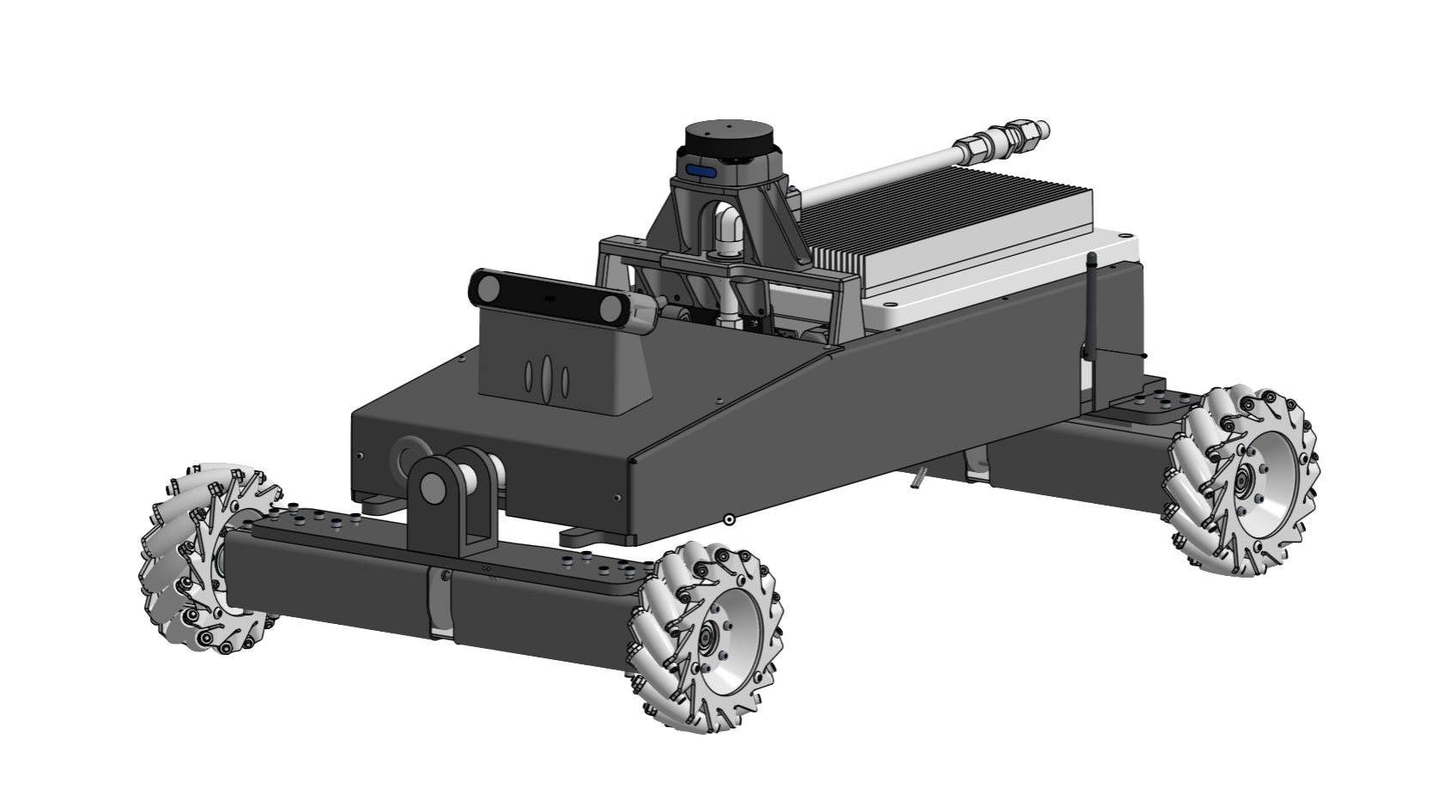

That means if you buy a Lucid Bots Sherpa Drone, a Sherpa Drone and Tethered system, or our Lavo Bot and Sherpa Drone combo, you could potentially write off the entire amount this year and not spread it over 5 or 7 years like before.

EisnerAmper notes that this provision now applies to both new and used assets, and it’s permanent, so you get the deduction right away, improving your cash flow. - Expanded Section 179 Deduction

The OBBBA also raises the Section 179 deduction limit to $2.5 million, with a phase-out beginning at $4 million.

Section 179 lets small businesses deduct equipment purchases that are actively used for work. So this is your trucks, pressure washers, and yes even our drones.

As EisnerAmper’s Real Estate update explains, this expansion makes Section 179 far more powerful for smaller operators, especially those upgrading tools, vehicles, or building systems.

How This Works in Real Life

Let’s say you run a small exterior-cleaning or maintenance company and earned $300,000 in profit this year.

You decide to purchase a Lucid Sherpa Drone for $90,000 in November 2025.

If you qualify under Section 179 or 100% bonus depreciation, you can deduct that full $90,000 from your taxable income lowering your taxable earnings to $210,000.

That could translate to tens of thousands of dollars in tax savings, depending on your state and filing status.

Why Timing Matters

Many of these incentives like 100% bonus depreciation and the higher Section 179 limits are tied to equipment placed in service after January 2025.

But here’s the key:

Projects and purchases made before the end of 2025 are best positioned to take full advantage of the bill before any future tax adjustments or sunsets kick in.

So, if you’ve been planning to expand your cleaning fleet, the 2025 tax year is your window to buy and deploy your equipment.

Why It’s Perfect for Lucid Bots Customers

Lucid Bots builds robots that help you do more with less. Our Sherpa Drones replace risky, slow manual cleaning work letting you take on bigger jobs with the same crew.

Because drones like Sherpa qualify as business equipment, they can be deducted under the same rules outlined in EisnerAmper’s OBBBA analyses. That means your investment could reduce your tax bill while expanding your capacity.

And if you’re planning to grow your business in 2026, now might be the perfect time to purchase more than one drone to take more advantage of 2025’s powerful tax incentives before they change.

Important Note

This article is for informational purposes only.

It is not financial or tax advice.

Tax laws can change, and your business situation is unique. Always check with your licensed accountant or tax advisor to confirm eligibility before making purchasing decisions.

Bottom Line

The Big Beautiful Bill was designed to reward small businesses that invest in American infrastructure and that includes companies keeping our buildings clean, bright, and safe.

By purchasing your Lucid Bots drone before December 31, 2025, you can:

- Save big on taxes

- Boost cash flow

- Get to work faster with safer, smarter tech

In short: make 2025 the year your business takes flight and let the Big Beautiful Bill help fund your future.

Related Articles

Lucid Bots Podcast

How Ryan Godwin is Transforming Exterior Cleaning with the Sherpa Drone

Dive into the future of exterior cleaning with Ryan Godwin, the visionary behind Lucid Bots. Discover how Ryan is leveraging cutting-edge robotics to revolutionize cleaning for buildings and outdoor surfaces—boosting efficiency, safety, and sustainability.

.avif)

.svg)

.avif)

.avif)